Budget Cost Field Specification

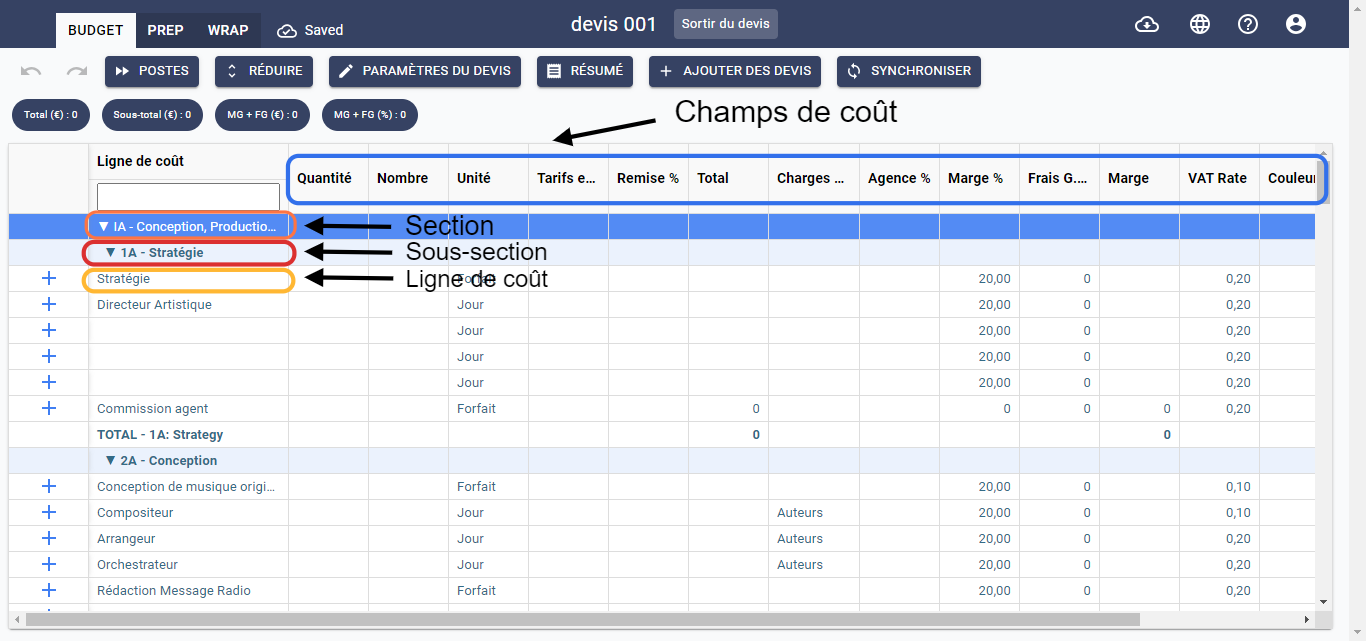

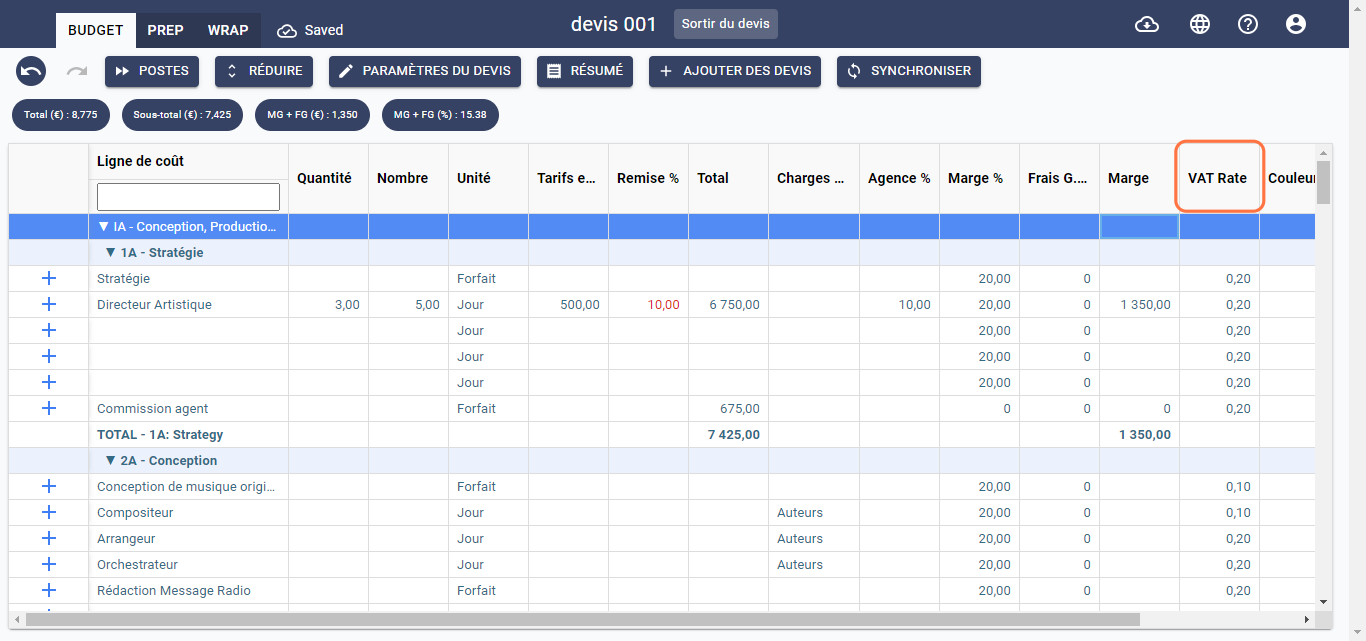

The budgeting matrix of a Post-Production Sound - France estimate consists of rows representing sections, subsections, and production cost lines, along with columns, each representing a cost field, as shown below:

Scroll to the right to view all cost fields.

To specify cost fields for each line of the estimate, follow the steps below:

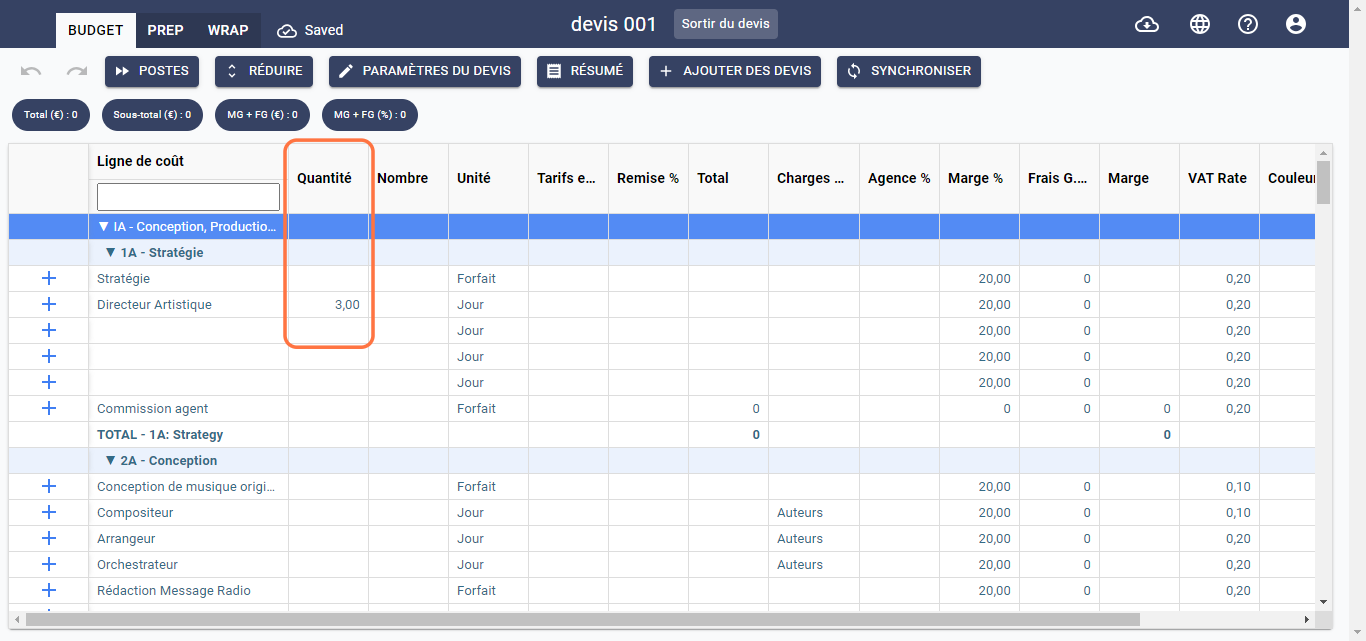

Quantity

This field allows you to specify the quantity of a cost item. For example, if you need three Art Directors for a production, you would enter the value 3 in the Quantity cell, as illustrated below:

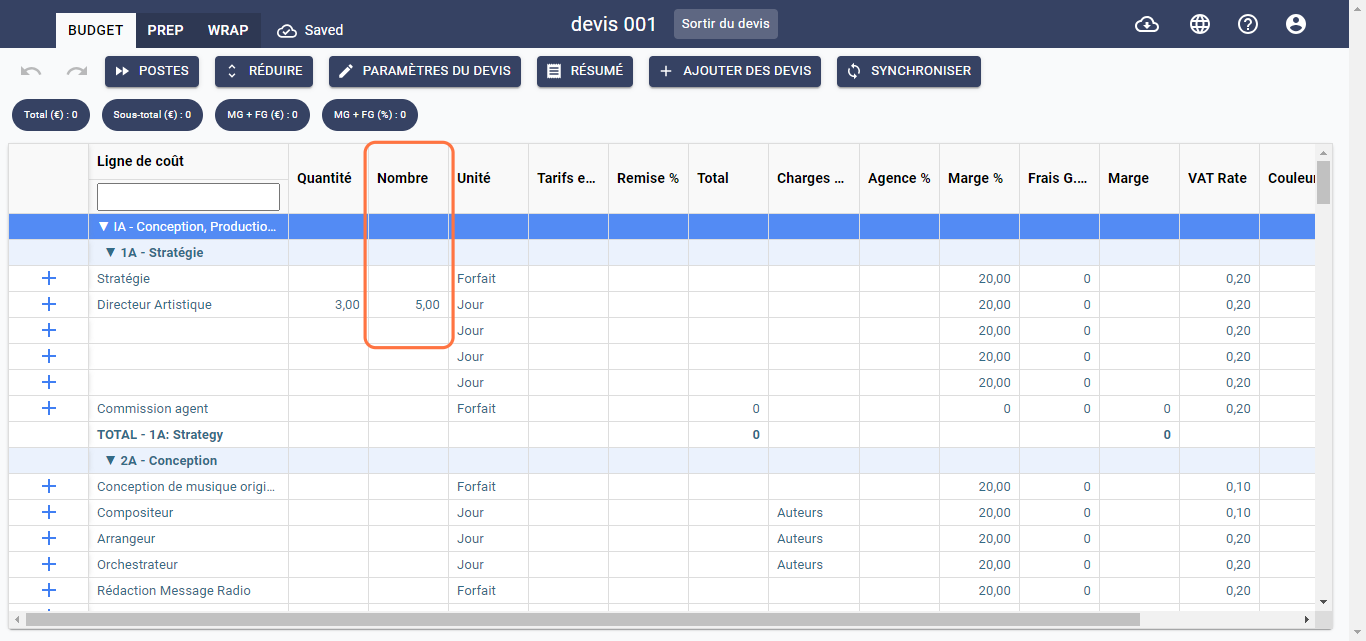

Number

This field allows you to define the total period for which a cost item is required. The period is selected in the Unit column. For example, if you need an Art Director for 5 days, select Days as the unit in the Unit column and specify the number as 5 in the Number cell, as shown below:

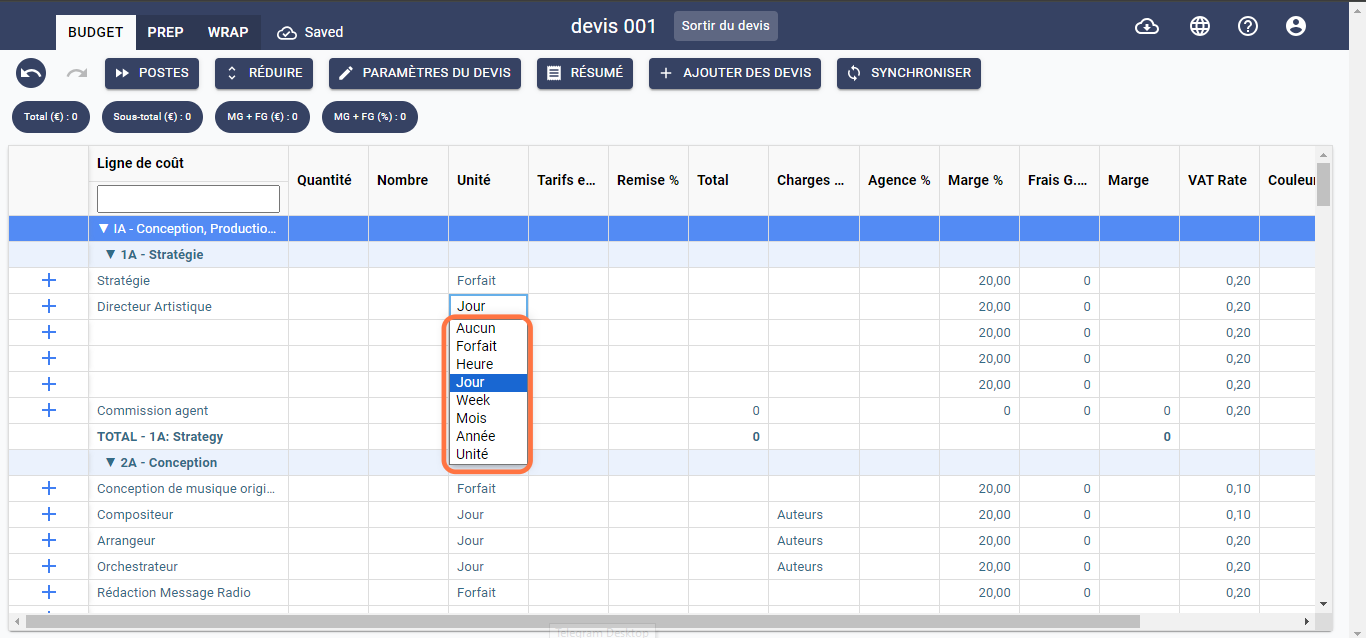

Unit

This field allows you to select a unit of time period. Double-click on the corresponding cost line in this column, and a context menu will appear. Choose the unit you want, as illustrated below:

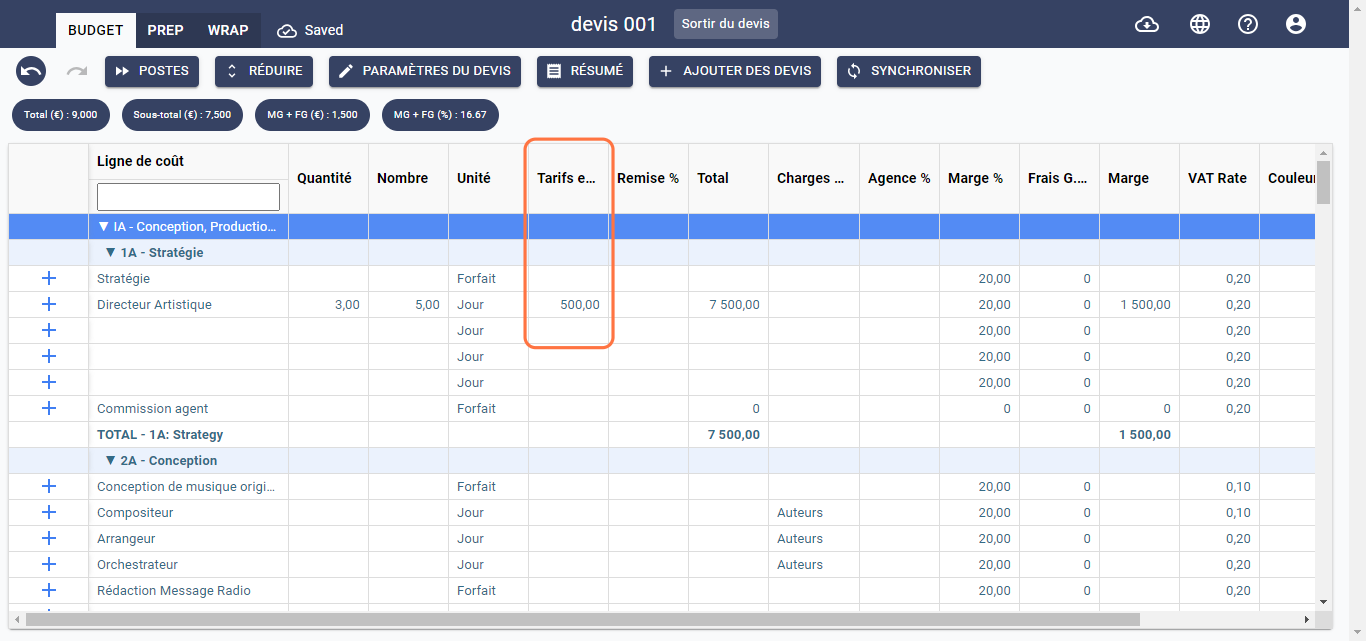

Rates

This field allows you to specify the rate of a cost item in the local currency. For example, if you have an Art Director that costs you 500 euros in France, enter the value 500 in the Rates cell in the line dedicated to the Art Director, as shown below:

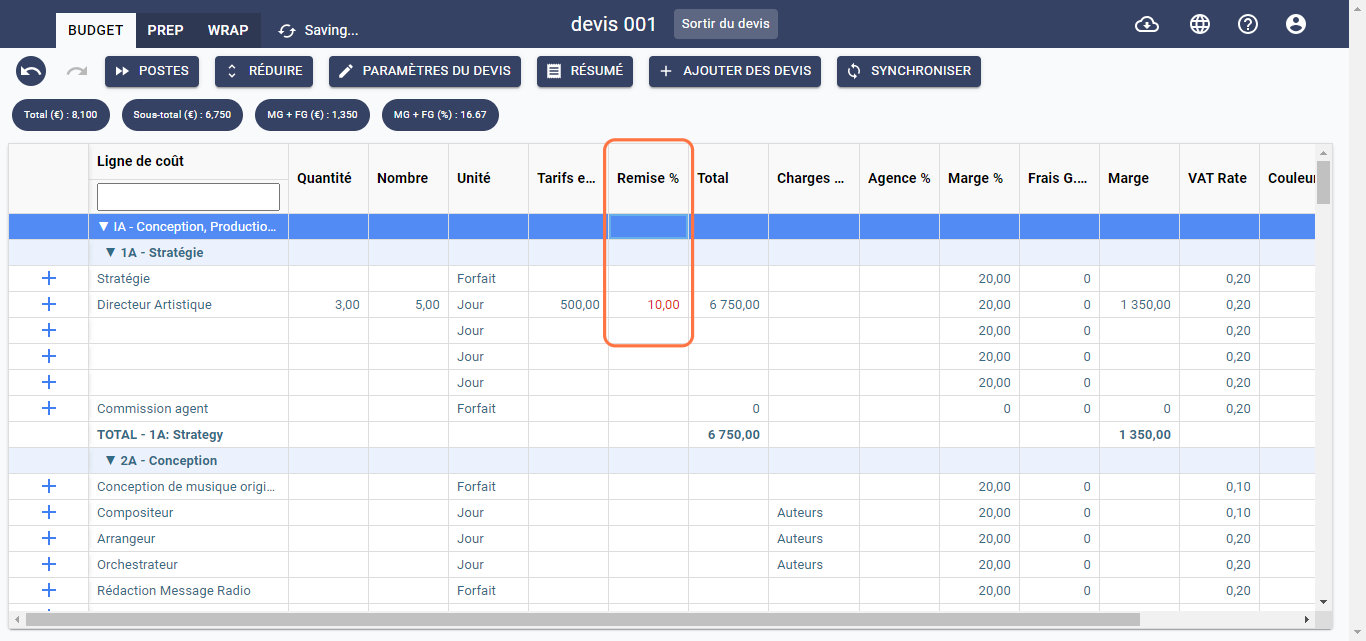

Discount %

This field allows you to apply a discount to a specific cost line. For example, by applying a 10% discount to the Photographer - Salary, the totals of the respective section and the overall estimate will be impacted by this reduction, and the percentage entered in this cell will be displayed in red, as shown below:

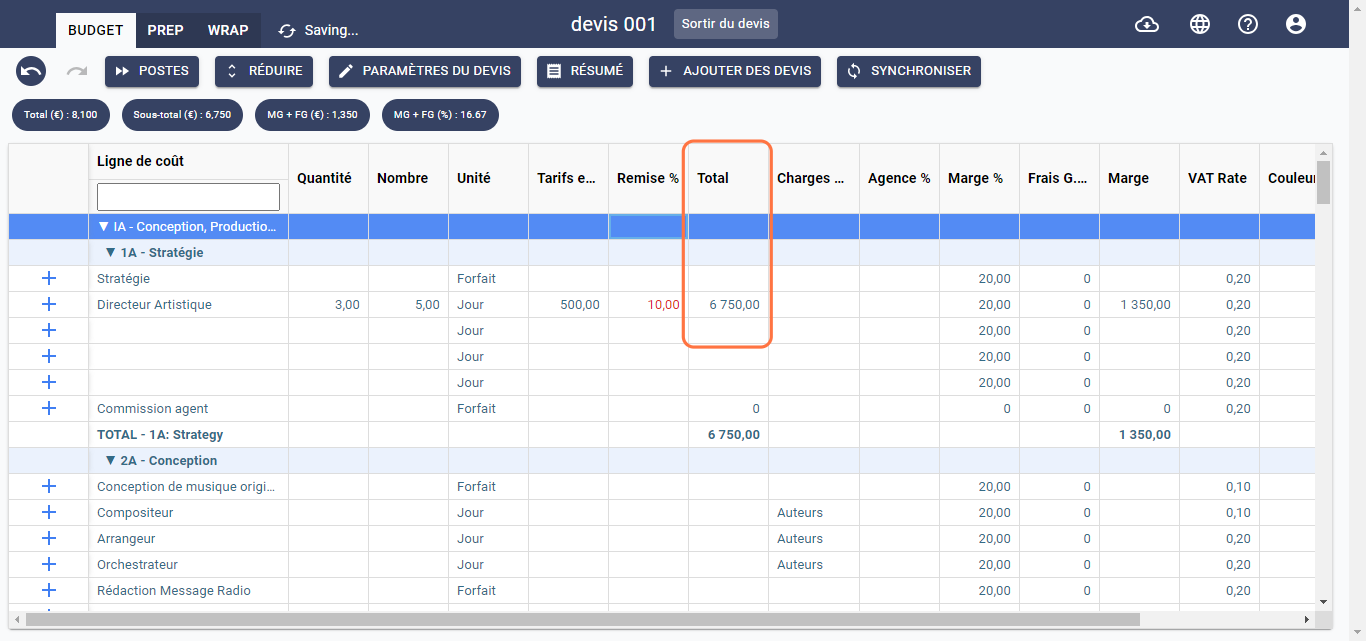

Total

This field calculates the total cost of a cost item in your budget's currency. This rate is calculated using the following formula: Quantity Number Local Currency Rates * (1-Discount).

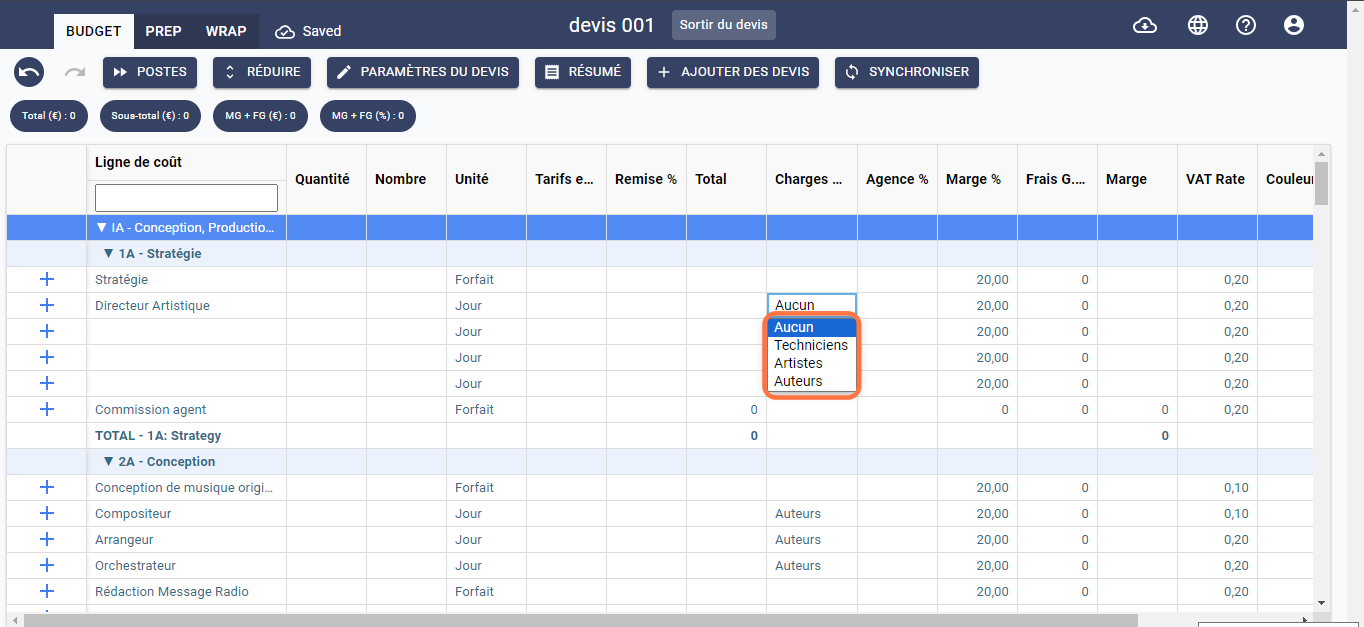

Social Charges

This field allows you to specify whether the wage tax applies to the cost item or not. If the wage tax is applicable to the cost item, double-click on the corresponding cost line in this column, and a context menu will appear. Select a type of wage tax; otherwise, leave the cell empty.

If you want to learn more about social charges, refer to the Model Dependencies section or click here to access it.

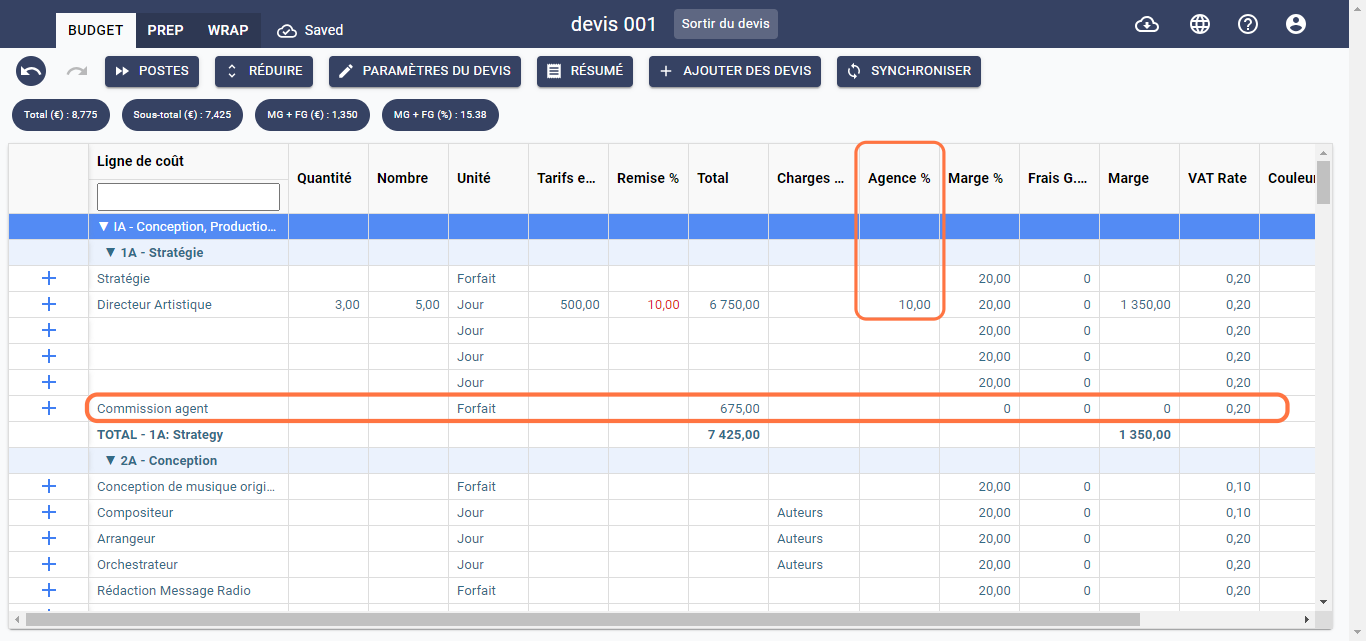

Agency %

This field allows you to specify the agent's commission as a percentage. Once filled, a cost line named Agent Commission is automatically filled in the same subsection, as shown below:

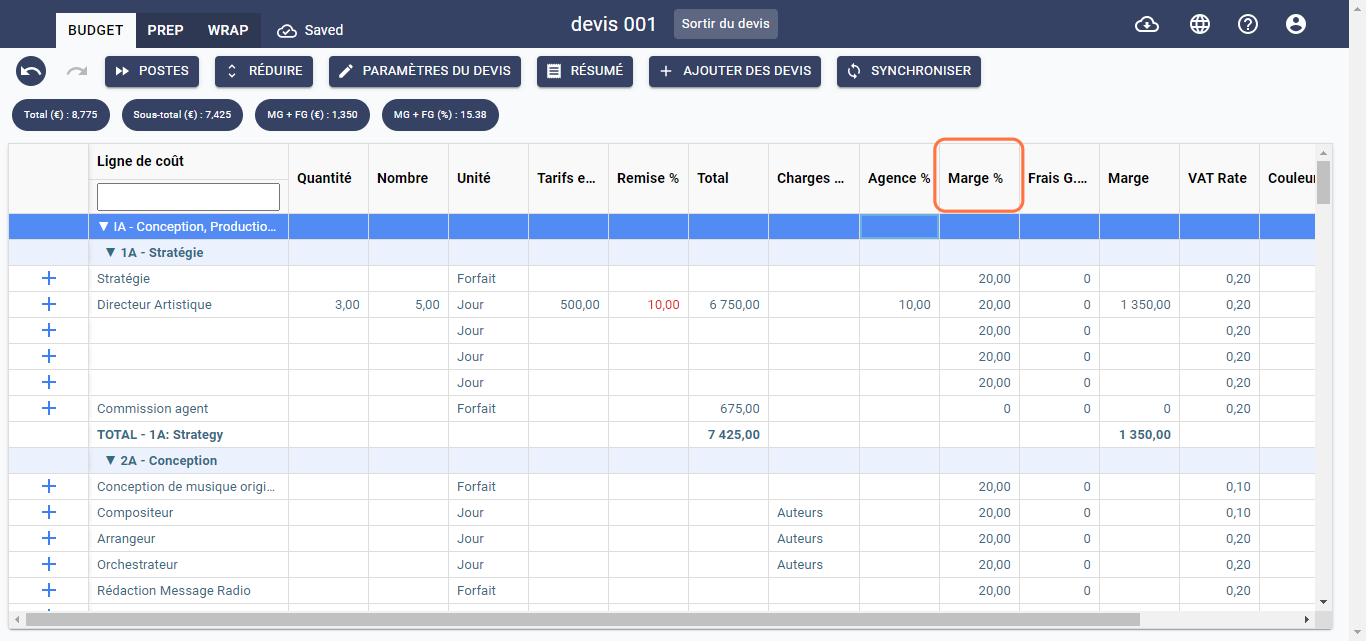

Margin %

This field allows you to specify the percentage of margin applied to the cost item. By default, this field's value is automatically set. This value is linked to the margin percentage specified in the Financial Settings at the time of creating the estimate. You can modify this value at any time without affecting the rest of the estimate. The margin percentage column appears as shown below:

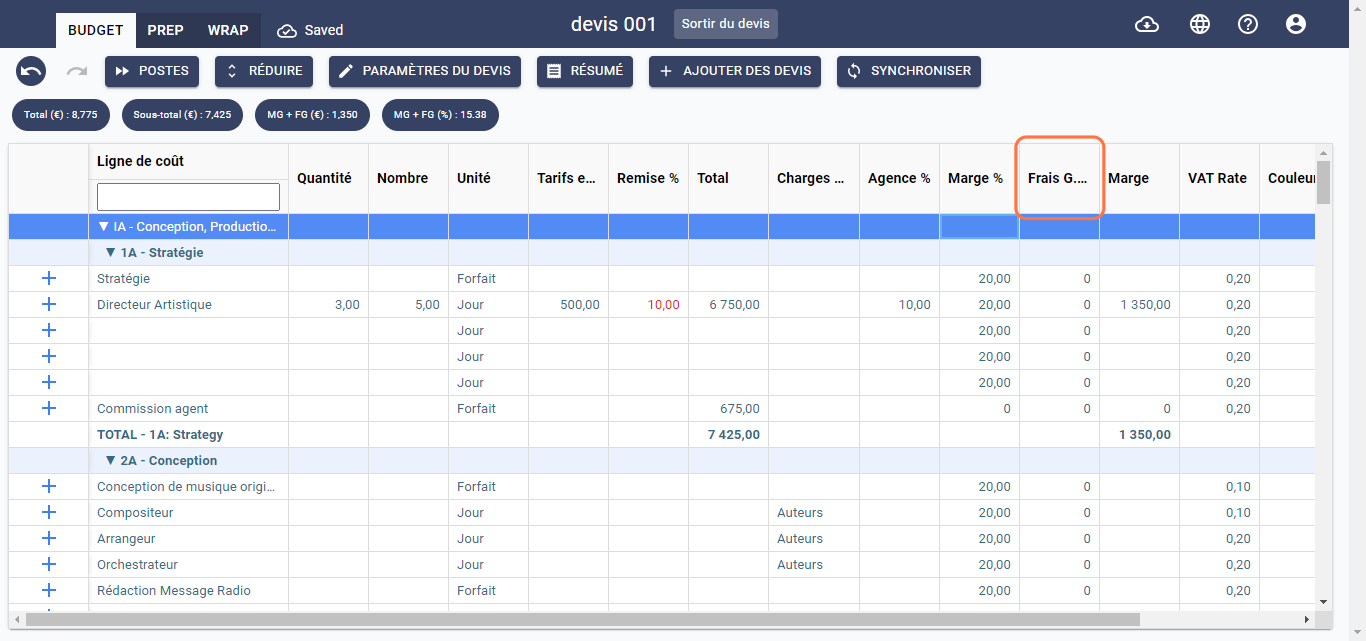

General Expenses %

This field allows you to specify the percentage of general expenses applied to the cost item. By default, this field's value is automatically set. This value is linked to the margin percentage specified in the Financial Settings at the time of creating the estimate. You can modify this value at any time without affecting the rest of the estimate. The general expenses percentage column appears as shown below:

For more information on Margin and General Expenses, please refer to the FAQ or click here to better understand the use of this feature.

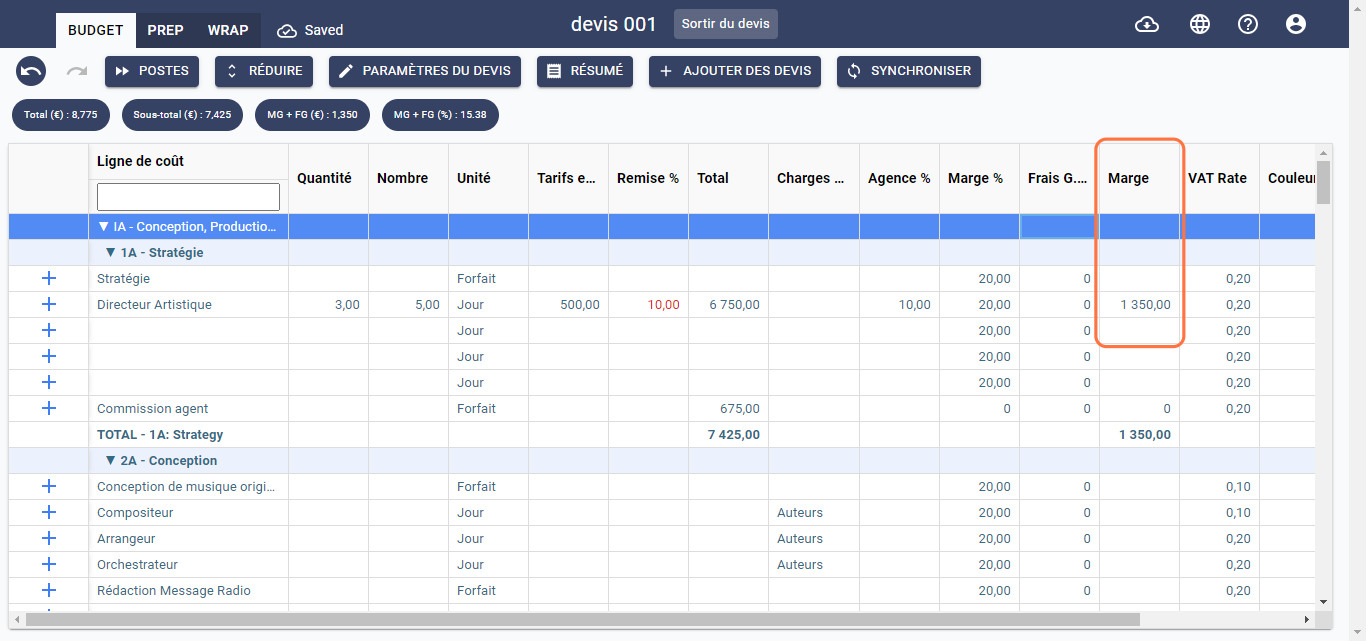

Margin

The software calculates the overall margin based on the specified cost values. This calculation is automatic.

VAT Charge Rate

This column displays the individual VAT rate for each line.

This cell cannot be modified.

To apply the individual VAT rate for each line, make sure to check 'Budget tax rate' when editing the invoice.